Middle East North Africa (“MENA”)

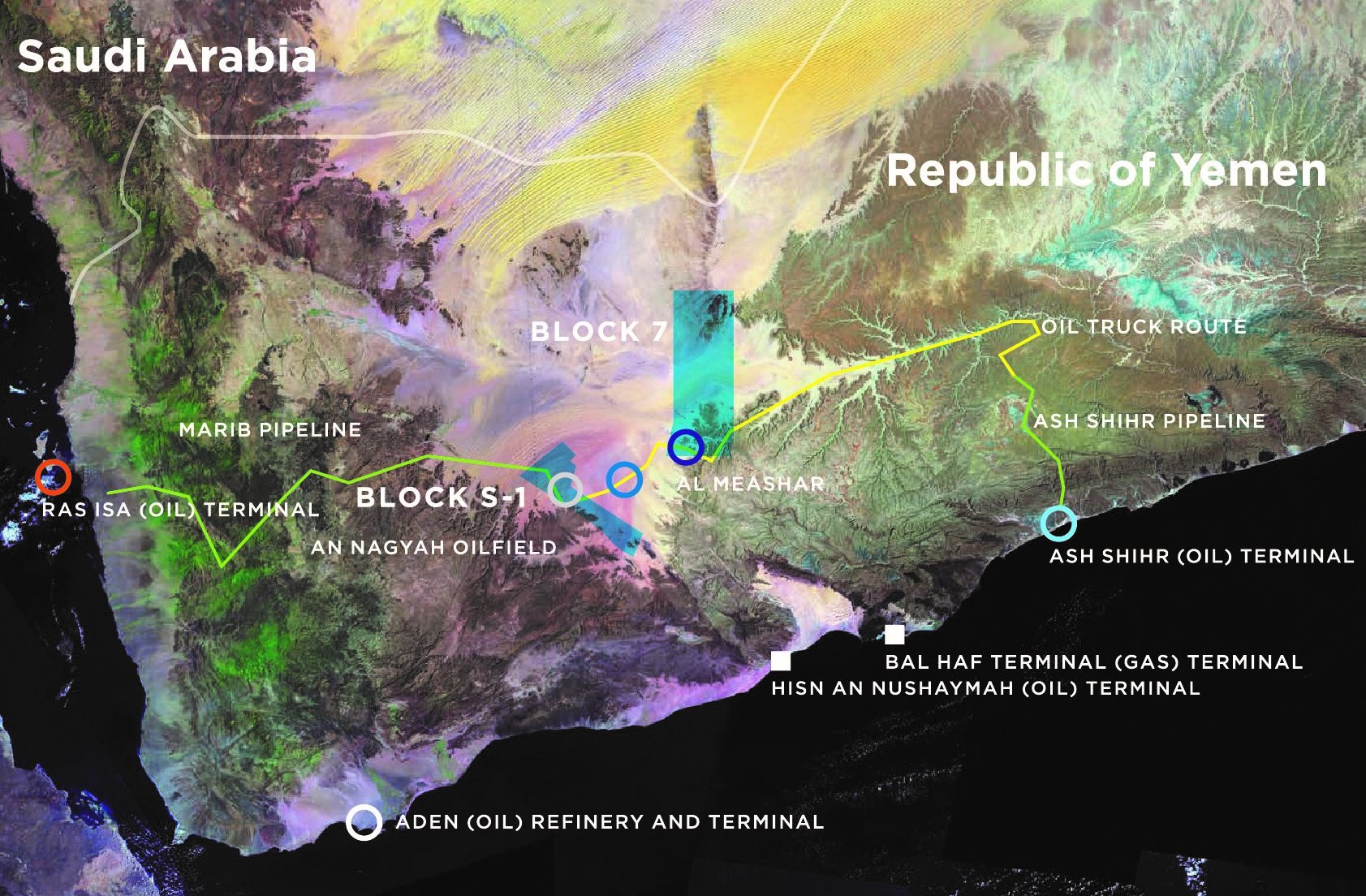

The Company holds rights to working interests in two blocks in Yemen, 80 kilometres apart in the Marib Basin – Damis Block S-1 Production Licence and Al Barqa, Block 7 Exploration Licence.

The Damis Block S-1 Production Licence in the Shabwah Governate contains five oil and gas fields, with target resources in excess of 54 million barrels of oil and 550 Bcf of natural gas. One field, the An Nagyah Oilfield is developed, with 32 wells, and has associated production facilities capable of producing 20,000 bopd, connected by an 80,000 bopd pipeline to Block 5 and the Marib Pipeline which terminates at the Ras Isa Oil Export Terminal on the Red Sea to the West. The Marib Pipeline and Ras Isa Oil Export Terminal have been shut since March 2015 due to the Saudi Coalition embargo on oil lifting from the Port of Hodeidah because of the Rebels’ control of Hodeidah. In 2020, a pipeline between Block 5 and Block 4 was completed which when commissioned once Block 5 restarts production, expected in the fourth quarter of 2021, will allow An Nagyah oil to flow to Block 5 thence South through the Block 4 pipeline to the Rudum Export Terminal at Bir Ali, for export and sale.

Al Barqa, Block 7 is a 5,000 square kilometre (1,235,527 acres) area in the Shabwah Governate, which holds the undeveloped Al Meashar Oilfield discovery with target resources of 11 to 110 million barrels of oil and four prospects which range between 174 and 439 MMbbls potential.

Al Barqa (Block 7) Exploration Permit, Republic of Yemen

Operator: Oil Search (ROY) Limited

Working Interest: 75%; Participating Interest: 63.75%

Block 7 is an onshore exploration permit covering an area of 5,000 square kilometres (1,235,527 acres) located approximately 340 kilometres East of Sana’a, 80 kilometres North East of the Company’s Damis (Block S-1) licence, and 14 kilometres West of OMV’s Habban Oilfield. The block contains two wells that were drilled on the Al Meashar prospect as well as an inventory of leads and prospects identified by 2D and 3D seismic surveys with significant oil potential.

The Company has operatorship and holds a 75% working interest (63.75% participating interest) in the Al Barqa (Block 7) Joint Venture.

Damis (Block S-1) Production Licence, Republic of Yemen

Operator: Octavia Energy (Block S-1), Inc.

Carried Working Interest: 25%; Participating Interest: 20.625%

Petsec Energy acquired 100% of the block late 2015/early 2016 from wholly owned subsidiaries of Occidental Petroleum Corporation and TransGlobe Energy Corporation.

Damis (Block S-1) is located approximately 80 kilometres to the southwest of Block 7 and holds five sizeable oil and gas discoveries – the developed and productive (until suspended in 2014), An Nagyah Oilfield, and a further four undeveloped oil and gas fields – Osaylan, An Naeem, Wadi Bayhan, and Harmel.

The developed An Nagyah Oilfield has produced around 25 million barrels of oil since start of production in 2004 out of the original recoverable reserves of 50 million barrels of oil. 1

The four undeveloped fields hold substantial oil and gas resources of approximately 35 MMbbl of oil and 600 Bcf of gas 2 representing substantial potential future growth of reserves and production for the Company.

The Company had been seeking, since 2017, government approvals to access government owned export transport facilities. In late 2019, the Yemen Oil Minister indicated that those approvals were predicated on the Company securing a financially strong and experienced Yemen oil producer to operate Block S-1.

Late in 2020, the Company secured a financially strong and experienced Yemen oil producer to operate Block S-1 as required by the legitimate Yemen Minister for Oil, in order to receive government approvals to access export transport facilities which would permit the restart of oil production from the An Nagyah Oilfield in Block S-1.

All of the shares of Yemen (Block S-1), Inc., the designated operator of Block S-1 and owner of a 75% working interest, were acquired by Yung Holdings Limited, a Hong Kong domiciled company and subsidiary of the Octavia Energy Corporation, a UK company focused on oil and gas exploration and production in the MENA region. Octavia Energy is financed by members of the Hayel Saeed Anam family, owners of the HSA Group of Companies, one of the Middle East’s most successful family enterprises, and Yemen’s largest, with over 35,000 employees and a multi-billion dollar annual turnover.

Yung Holdings Limited was established in 2016 to acquire Calvalley Petroleum (Cyprus) Ltd which holds a 50% interest and is the operator of Malik Block 9 in the Masila Basin of Yemen. The block was returned to production in 2019 following an investment of US$45 million, and is currently producing 6,500 bopd, which is trucked to the Block 4 pipeline thence to Bir Ali for export. The Block 9 joint venture includes Hood Oil, owning a 25% interest since 2002, a subsidiary of Hayel Saeed Anam and Co. (H.S.A.), and Medco Energi, an Indonesian listed company, holding a 25% interest.

Yemen (Block S-1) Inc., the operator of Damis Block S-1, has been renamed Octavia Energy (Block S-1), Inc. and has established its Block S-1 operations offices in Cairo, Egypt and Aden, Yemen.

- Based on estimates by previous operator and DeGolyer and McNaughton Canada Limited. The Company intends to commission a new reserves report after the resumption of production.

- Source: Wood Mackenzie Asia Pacific Pty Ltd (November 2015)